1. What is a Personal Financial Statement?

A Personal Financial Statement is a form, document or spreadsheet, that shows the financial position of individuals at a given point in time.

Collecting and organizing information, presenting it in a document or spreadsheet universally accepted by banks, lenders and other financial professionals.

It will help you gain a loan, you can get into different investment transactions, or develop financial goals and strategies for minimizing income taxes.

Personal Financial Statement typically consists of personal assets, liabilities, equity and your personal net worth.

Blueprint For Financial Success:

(i) Developing a plan to meet your financial goals.

(ii) Tracking your progress with respect to that plan.

Too often people set unclear goals (“I want to be rich.”), make unrealistic plans, or never bother to assess the progress toward their goals.

A personal financial statement is the best method for you to understand and monitor both in setting goals and attaining them.

2. Personal Financial Statement Template

A personal financial statement template is a great tool to track your financial health.

Financial statements are the most widely used and most comprehensive way of evaluating financial health.

Personal financial statement template can help you examine some primary factors that got you there and discover what you really want to achieve in your life financially.

You can discover tricks to help you out of personal money management, streamline your financial records, improve your credit rating.

A personal financial statement template plays a vital role in exploring your current financial situation.

3. Personal Financial Statement Form

A personal financial statement form(Download) is a spreadsheet or document detailing a person’s financial state at a particular time.

Do you have a financial document that you don’t know what to do with? And want a system to manage all this mess.

Well, you aren’t alone. Most people dealing with the same problem, regular maintenance to keep their financial records in good shape.

Getting organized takes time, but you’ll be very glad if you do it. A personal financial statement form is going to help you to organize all this mess.

Imagine no more late payments and fees merely because you misplaced a credit-card bill, tax records that you can organize in minutes rather than hours.

4. Example of a Personal Financial Statement

Some of them are meeting with a banker, lender or investor who will want to review financial statements.

Measuring your financial health helps you to understand where you are financial. If you do not know where you are, how can you determine how to get to where you need to be?

To understand your financial health, develop a balance sheet, an income statement, and a budget, and calculate your financial ratios.

Analyze where you are financially at this moment – are you financially active? Are you financially stable (do you have sufficient cash in your wallet or bank balance to pay your bills)?

How much debt do you have? what amount are you saving each month and year? Personal financial statements play an important role when an individual is applying for a personal loan, business loans or a mortgage.

A personal financial statement (“PFS”) allows the banker to analyze the person’s financial flexibility to pass the loan.

This will helps the applicant to get approved for financing or loans. In many cases, applicants asked to provide a personal guarantee or personal assets to guarantee the loan.

Evaluating personal financial statement uncover the individual’s financial flexibility to understand the improvements or deteriorations over a period of time.

Personal financial statement plays an important role in your financial goals. It helps to clarify your cash inflows and outflows in order to increase your net cash flow.

It will help an individual to reach his or her financial goals. Tracking your financial statements history is the best way to measure your progress.

Your personal financial statement will give you a clear picture of what direction and by how much you are moving.

It will help you to understand clearly what is slowing you down and what is helping your wealth grow faster.

Not until you put these things to document or spreadsheet, you will be able to see clearly the way of the money around you.

5. Personal Financial Statements

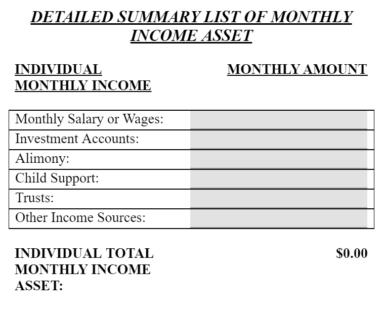

The income statement summarizes incomes and expenses for a period of time.

In personal finance, income is what you earned as wages or salary and as interest or dividends, and expenses are the costs of things consumed in the course of daily living: the costs of sustaining you while you earn income.

The income statement display revenue generated by the company during a specific period of time and what costs involved in generating that revenue.

The income statement is a blueprint of what you have earned and what your cost of living was while earning it.

The difference is personal profit, which, if accumulated as an investment, becomes your wealth.

Net income (revenue minus all costs) is referred to as the “bottom line” on the income statement because of its closeness to the base of the income statement.

The income statement clearly shows your income and expenses. Here you can analyze those expenses which consume the greatest portion of your income or which expense has the greatest or least effect on your bottom line.

It will help you to reduce your expenses and free up more income.

Cash Flow Statement

The cash flow statement shows how much cash came in and where it came from, and

how much cash went out and where it went over a period of time.

The Cash flow statement describes the person’s solvency, financial flexibility, liquidity and the ability to meet financial obligations and opportunities.

The cash flow statement is different from the income statement because it comprises, cash flows that are not from income and expenses.

The cash flow statement is important because it can show how well you do at creating liquidity, as well as your net income.

Liquidity is nearness to cash, and liquidity has value. A lack of liquidity must be addressed by buying it or borrowing, creating an additional expense.

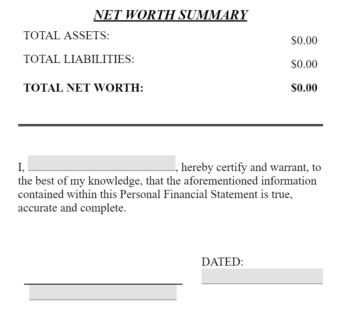

Balance Sheet

In personal finance, one of the important things is the balance sheet which helps you to analyze the current situation.

Often referred to as the “statement of financial condition,” the balance sheet is a snapshot of what you have and what you owe at a given point in time.

The balance sheet represents the current financial condition by disclosing resources to the individuals or company’s (assets) what he owes (liabilities) at a particular period of time.

A balance sheet is different from the income or cash flow statements, it is not a document of performance over a period of time, but its a statement, where things stand at a certain moment.

Basically, a balance sheet is a list of assets, liabilities, and equity or net worth, with their values.

In personal finance, assets are the things that can be sold to convert into liquidity.

Liquidity is needed to repay debts. Because your assets are what you use to repay your debts when they become due, the assets’ value should be greater than the value of your debts.

6. How Do I Prepare a Personal Financial Statement?

Making your own personal financial statement is very useful it will help you to design and evaluate your financial plan, help you to become better to manage your personal finance.

More importantly, help individuals applying for credit such as personal loans, business loans or mortgages.

The personal financial statement helps credit officers to easily measure your financial health to make a decision.

Your credit officer or banker will understand that the financial data is improving or decreasing as you go about making your financial transactions (making payments, for example) as well as how your investment values changing over time.

The financial statement can be created for either a firm or an individual for the purpose of understanding the financial condition of a firm or an individual by collecting the data in the form of a document or spreadsheet.

The process for creating a personal financial statement differs from the financial statement created for entity or organization.

Financial statements represent the outcome of the transaction and the financial condition of the company.

Reporting financial statements provides information about their achievements, financial condition, and transition in the financial condition that is useful to a wide range of uses in making financial decisions.

The role of personal financial statement analysis is to collect or gather financial reports prepared by analysts or self-created, combined with other information.

To evaluate the past, current, and prospective performance and financial position of an individual for the purpose of making an investment, credit, and other financial decisions.

Preparing a personal financial statement starts with listing your data related to all your assets and liabilities.

The personal financial statement clearly represents your assets and liabilities and net worth at a given period of time.

Make sure of adding your latest data about personal finance to create a definitive outcome.

7. Steps Involved in Creating PFS

1. Clarify the Purpose

It is very important to understand the purpose of the analysis. The purpose of analysis guides further decisions about the approach, the tools, the data sources, the format in which to report results of the analysis, and the relative importance of different aspects of the analysis.

The time of facing a considerable amount of data, a less experienced person may be tempted to just start crunching numbers and creating output.

It is generally advisable to resist the temptation and thus avoid the pointless number crunching.

2. Collect Data

A key part of this step is obtaining an understanding of the person’ s financial performance, and financial position.

For past analyses, financial statement data alone are adequate in some cases.

By comparing personal financial statements over time, an individual can record how their financial health is improving or deteriorating.

Listing all assets and liabilities and income, expenses can be added but usually, these are arranged in the income statement.

3. Process Data

After collecting the essential data for financial statement and other information, process

this data using appropriate analytical tools.

Usually, Data processing involves computing ratios or growth rates, creating common – size financial statements; preparing charts; performing statistical analyses.

Using various analytical tools or combination of tools that are available and appropriate to the task.

4. Translate Data

Once the data have been processed, the next step — critical to any analysis — is to translate the output.

The answer to a specific financial analysis question is seldom the numerical answer alone; the answer to the analytical question relies on the translation of the output and the use of this translated output to support a conclusion or recommendation.

5. Develop Conclusion

Developing the conclusion or recommendation in a proper format is the next

step in the personal financial statement. The proper format will vary by analytical task, can vary from person to person.

Finally when preparing and presenting a conclusion for your personal financial statement, be sure, honest and accurate.

Don’t try to change the document if you have a negative net worth just let it be what it is.

Summary

The primary purpose of the personal financial statement is to provide information and data about a person’ s financial position and performance, including profitability and cash flows.

The information presented in personal financial statement reports — including personal assets, liabilities, equity and your personal net worth — allows the bankers, lenders, and other financial professionals to assess a person’s s financial position and performance.

And it will also help you to get a loan, you can get into different types of investment transactions, or develop financial goals and strategies for minimizing income taxes and you can reach your financial objectives.